summit county utah sales tax

Additional Information Contact the Tax Commission with questions at. Look up 2022 sales tax rates for Summit Utah and surrounding areas.

Summit County Sheriff S Deputies Arrest Two In Drug Bust On I 80 Parkrecord Com

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335.

. According to Sales Tax States 61 of Utahs 255 cities or 23922 percent charge. The sales tax numbers are estimates based on the l local option tax that is assessed in Park City. The assessors office also keeps track of ownership changes.

The Combined Sales and Use Tax Rates chart shows taxes due on all transactions subject to sales and use tax and includes. Alphabetical listing of all Utah citiestowns with corresponding county. To review the rules in.

You can find more tax rates and allowances for Summit County and Utah in the 2022 Utah Tax Tables. Businesses shipping goods into Utah can look up their customers tax rate by address or zip code at taputahgov. The 2018 United States Supreme Court decision in South Dakota v.

UT Rates Calculator Table. Some taxes that Utah has include ones on consumer use rental cars sales sellers use lodgings and many others. Help us make this site better by reporting errors.

Thats what the council will discuss Wednesday but it wont take a vote until June 15. This is the total of state county and city sales tax rates. Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84134 taxmasterutahgov 801-297-7705 1-800-662-4335 ext.

Rates include state county and city taxes. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tax rates are provided by Avalara and updated monthly.

It could generate an estimated 25 million in 2023. Publication 56 Utah Sales Tax Info for Lodging Providers. The Summit County Council established the Restaurant Tax Advisory Committee to investigate advise and recommend the best uses of the funds collected from this tax.

Cash management and investment duties are performed in. 274 rows Lowest sales tax 61 Highest sales tax 905 Utah Sales Tax. The committee is governed by the enabling.

For more information on sales use taxes see Pub 25 Sales and Use Tax General Information and other publications found here. Important Property Tax Dates. Manage Summit County Funds.

The Treasurer is responsible for the banking reconciliation management and investment of all Summit County funds. The following documents give cross-listings of Utahs cities towns counties and entity codes for sales and use tax purposes. The total sales tax rate in any given location can be broken down into state county city and special district rates.

Summit County Home Page. Streamlined Sales Tax SST Training Instruction. All Tax Commission Publications.

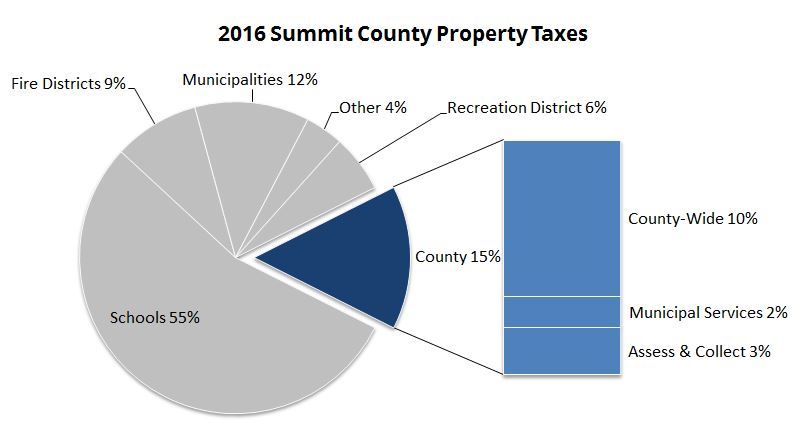

This table shows the total sales tax rates for all cities and towns in Summit. Finally all data presented in this report is organized by fiscal year and fiscal quarter. The tax rate is determined by all the taxing agencies-city or county school districts and others-and depends on what is needed to provide all the services you enjoy.

According to Grabau the 25 tax would cover about 13 of the annual funding for a minimal transit service. 2020 rates included for use while preparing your income tax deduction. This rate includes any state county city and local sales taxes.

You may register as a bidder for the tax sale by visiting this link. You can use our Utah Sales Tax Calculator to look up sales tax rates in Utah by address zip code. The current total local sales.

The Summit County Utah sales tax is 655 consisting of 470 Utah state sales tax and 185 Summit County local sales taxesThe local sales tax consists of a 135 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc. Average Sales Tax With Local. The 2022 Summit County Tax Sale will be held online.

The Summit Park sales tax rate is. Has impacted many state nexus laws and sales tax collection requirements. Always consult your local government tax offices for the latest official city county and state tax rates.

Wayfair Inc affect Utah. Did South Dakota v. Publication 25 Sales and Use Tax General Information.

Mycashutahgov for more information. Summit County UT Sales Tax Rate. Utah has a 485 statewide sales tax rate but also has 131 local tax jurisdictions including cities.

The Summit County sales tax rate is. The minimum combined 2022 sales tax rate for Summit Park Utah is. Obtaining a business license normally takes 5-10 business days from the time the application is submitted until the approval process is completed.

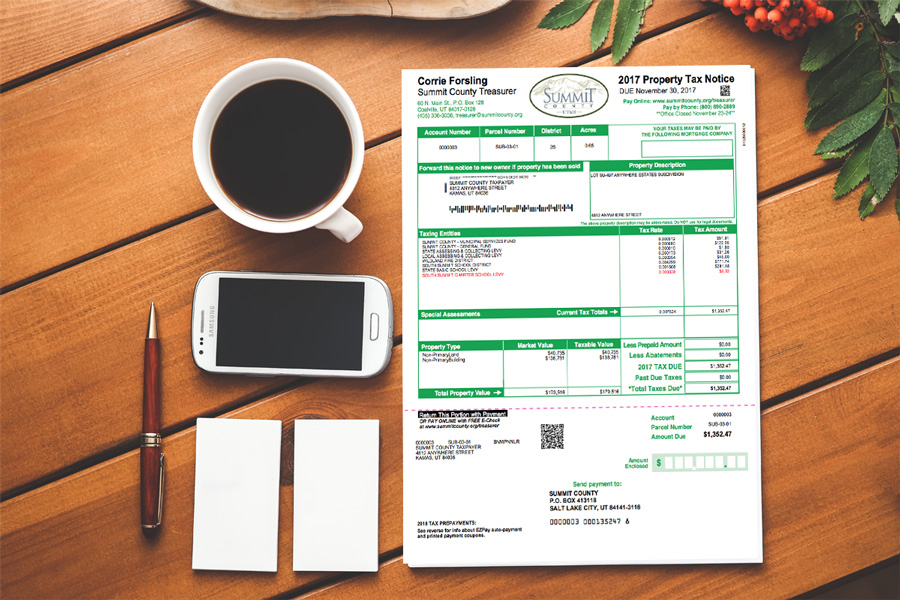

The amount of taxes you pay is determined by a tax rate applied to your propertys assessed value. Summit County Utah Recorder-4353363238 Assessor-4353363211. The primary purpose of the Restaurant Tax Grant is to promote tourism as set out by the Utah State Statute and the County Council.

The latest sales tax rates for cities in Utah UT state. 91 rows This page lists the various sales use tax rates effective throughout Utah. Summit County in Utah has a tax rate of 655 for 2022 this includes the Utah Sales Tax Rate of 595 and Local Sales Tax Rates in Summit County totaling 06.

The Utah sales tax rate is currently. 2020 rates included for use while preparing your income tax deduction. There are a total of 131 local tax jurisdictions across the state collecting an average local tax of 2108.

All Utah citiestowns listed alphabetically by county. Deadline for 2022 Tax Relief Applications. 2022 Property Tax Due Date.

State Local Option. The Utah state sales tax rate is currently. Utah has a 485 sales tax and Summit County collects an additional 155 so the minimum sales tax rate in Summit County is 63999 not including any city or special district taxes.

The fiscal year begins July 1 and runs through June 30 of. The County sales tax rate is. Tax rates are also available online at Utah Sales Use Tax Rates or you can contact the Tax Commission at 801-297-2200 or 1-800.

The 2018 United States Supreme Court decision in South Dakota v. 67 of the Utah Code Annotated and forwarded to the Utah State Treasurer after one year has elapsed from the date of the tax sale. The analysis does not deal with the Resort Community Tax 11 or the Citys Transit Tax 30.

2 days agoIt would levy 025 on all in-county sales transactions or a penny for every 4 spent.

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman

Utah Summit County Parcels Lir Utah S State Geographic Information Database Agrc

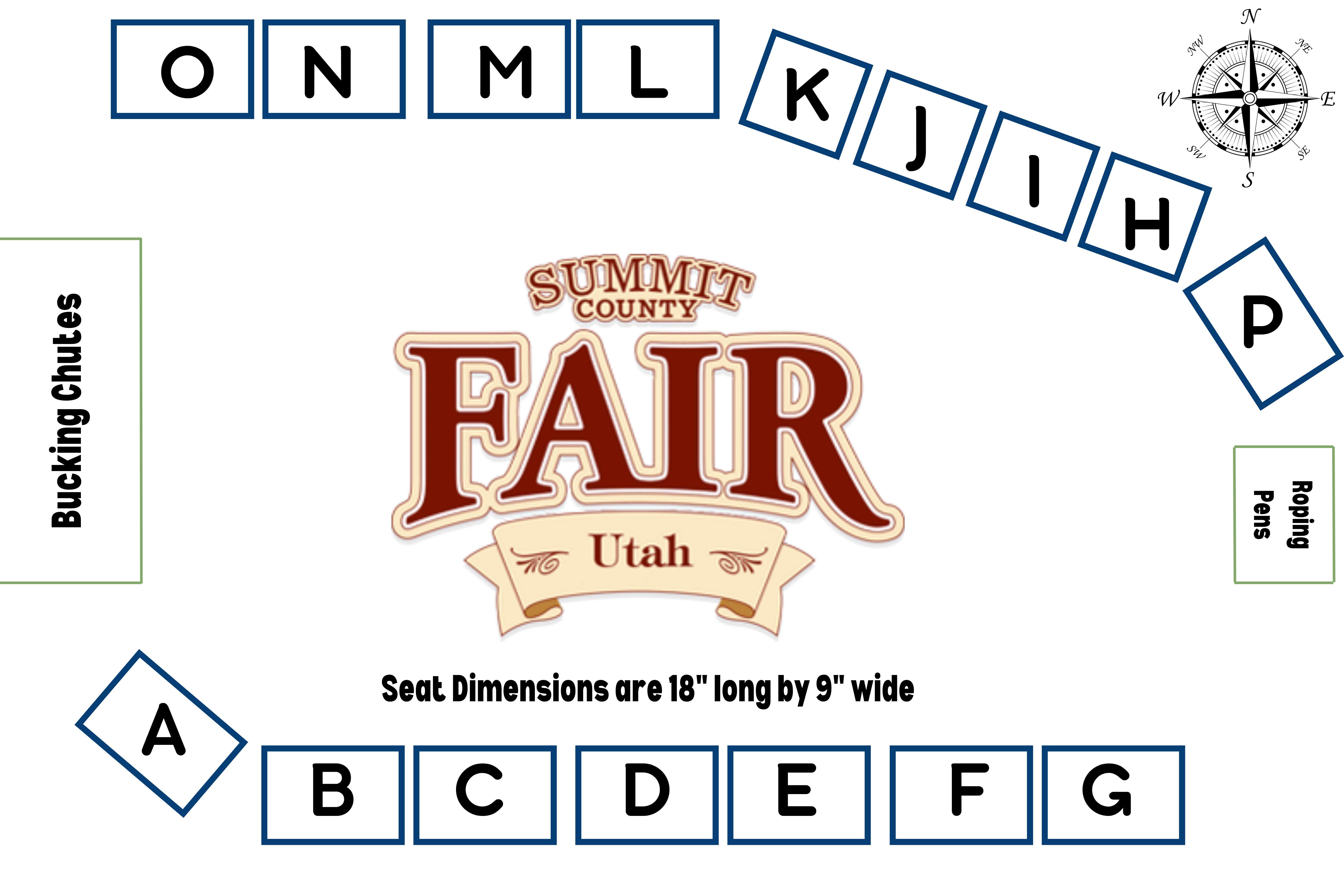

Demolition Derby Summit County Fair

Wasatch Summit County Property Taxes How They Work Park City Real Estate Agent Nancy Tallman

Corporate Retention Recruitment Business Utah Gov

Summit County Utah Republican Party

Pin By Meredith Dawn Kramer On Travel Hubs In 2021 Ski Area Deer Valley Park City

Salt Lake County Woman Killed In A Summit County Hunting Accident

Legislature Approves New Boundaries For Summit County Legislative Districts Parkrecord Com

One Utah Summit Oneutahsummit Twitter

What Is Utah S Sales Tax Discover The Utah Sales Tax Rate For 29 Counties

National Level Real Estate Forecast Real Estate Real Estate Information Real Estate Prices

International Youth Summit The Utah Council For Citizen Diplomacy

2022 Best Places To Live In Summit County Ut Niche

Utah Sales Tax Rates By City County 2022

Your 2018 Summit County Utah Property Taxes Explained Park City Real Estate Agent Nancy Tallman